1.0.7 • Published 4 years ago

binance_sa v1.0.7

Binance Websocket and Api

Use

const binance = require("binance_sa")({ apiKey: '', apiSecret: '' });server time

// get time server binance

let {serverTime} = await binance.serverTime();

console.log("st", serverTime);orderbook

websockt

// get order book with websocket and use object orderbook

let orderbook = await binance.orderbook({

pair: 'ethusdt',

type: 'futures', // optional spot:empty, futures:futures

});

console.log(orderbook.getOrderbook());

console.log(orderbook.getSymbol());

console.log(orderbook.getBestBid());

console.log(orderbook.getBestAsk());

console.log(orderbook.justInitialized());

await binance.tools.sleep(5000);

console.log(orderbook.getOrderbook());

console.log(orderbook.inspect());kline

websocket

// get order book with websocket and use object orderbook

let kline = await binance.kline({symbol: "BTCUSDT", interval: "1h"});

/*

m -> minutes; h -> hours; d -> days; w -> weeks; M -> months

1m, 3m, 5m, 15m, 30m, 1h, 2h, 4h, 6h, 8h, 12h, 1d, 3d, 1w, 1M

*/

kline.getKline()

kline.getsymbol()

kline.getInterval()

kline.inspect()api

let kline = await binance.klineSnapshot({SYMBOL: "bnbbtc", interval: "1m"});24hr status

let trade24hr = await binance.tiker24hr("bnbusdt");market

websocket

// get websocket market

let marketModel = await binance.market();

console.log("marketModel", marketModel.getMarket());pair

websocket

// get websocket pair data

var a = await binance.pair('ethusdt');

console.log('a', a.getCoin());

await binance.tools.sleep(5000)

console.log('a', a.getCoin());private apikey apisecret

get account info

var accountInfo = await binance.accountInfo(apiKey, apiSecret); // contain permisions and balances accountget asset

var assets = await binance.getAsset(apiKey, apiSecret); // get all assetcheck permission

var permission = await binance.checkPermission(apiKey, apiSecret); // get permisionsorder

SPOT :

add new order

var a = await binance.newOrder(apiKey, apiSecret, {

recvWindow: 60000,

symbol: 'BTCUSDT',

side: 'SELL', // SELL or BUY

type: "MARKET", //LIMIT or MARKET or STOP or STOP_LOSS_LIMIT

// timeInForce: 'GTC',

// quantity,

// price,

// newClientOrderId,

// stopPrice,

// quoteOrderQty: 50

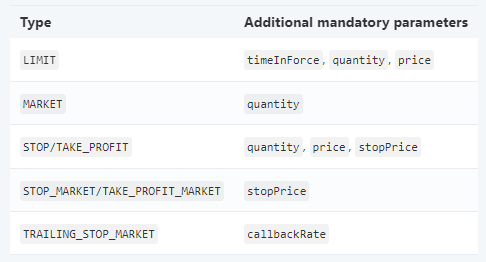

}); Some additional mandatory parameters based on order type:

Type | Additional mandatory parameters | Additional Information

LIMIT timeInForce, quantity, price

MARKET quantity or quoteOrderQty MARKET orders using the quantity field specifies the amount of the base asset the user wants to buy or sell at the market price.

E.g. MARKET order on BTCUSDT will specify how much BTC the user is buying or selling.

MARKET orders using quoteOrderQty specifies the amount the user wants to spend (when buying) or receive (when selling) the quote asset; the correct quantity will be determined based on the market liquidity and quoteOrderQty.

E.g. Using the symbol BTCUSDT:

BUY side, the order will buy as many BTC as quoteOrderQty USDT can.

SELL side, the order will sell as much BTC needed to receive quoteOrderQty USDT.

STOP_LOSS quantity, stopPrice This will execute a MARKET order when the stopPrice is reached.

STOP_LOSS_LIMIT timeInForce, quantity, price, stopPrice

TAKE_PROFIT quantity, stopPrice This will execute a MARKET order when the stopPrice is reached.

TAKE_PROFIT_LIMIT timeInForce, quantity, price, stopPrice

LIMIT_MAKER quantity, price This is a LIMIT order that will be rejected if the order immediately matches and trades as a taker.

This is also known as a POST-ONLY order.

Other info:

Any LIMIT or LIMIT_MAKER type order can be made an iceberg order by sending an icebergQty.

Any order with an icebergQty MUST have timeInForce set to GTC.

MARKET orders using quoteOrderQty will not break LOT_SIZE filter rules; the order will execute a quantity that will have the notional value as close as possible to quoteOrderQty. Trigger order price rules against market price for both MARKET and LIMIT versions:

Price above market price: STOP_LOSS BUY, TAKE_PROFIT SELL

Price below market price: STOP_LOSS SELL, TAKE_PROFIT BUYcheck order status

var a = await binance.checkOrder(apiKey, apiSecret, {

// recvWindow: 60000,

symbol: 'BTCUSDT',

orderId: 1,

// origClientOrderId: 1,

// cummulativeQuoteQty: "0.0",

});

console.log("aa", a);Notes:

Either 'orderId' or 'origClientOrderId' must be sent.

For some historical orders 'cummulativeQuoteQty' will be < 0, meaning the data is not available at this time.delete order

var a = await binance.deleteOrder(apiKey, apiSecret, {

// recvWindow: 60000,

symbol: 'BTCUSDT',

orderId: 1,

// origClientOrderId:1,

});

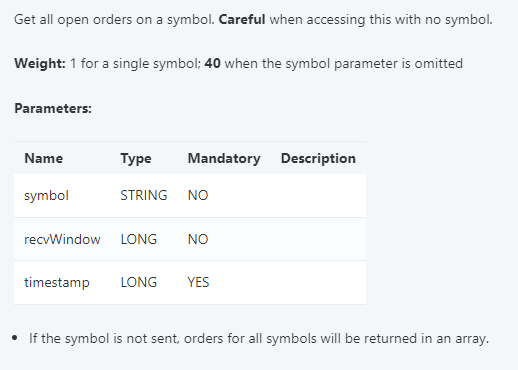

console.log("aa", a);get open orders

var a = await binance.openOrders(apiKey, apiSecret, {

symbol: 'BTCUSDT',

});

console.log("data", a);

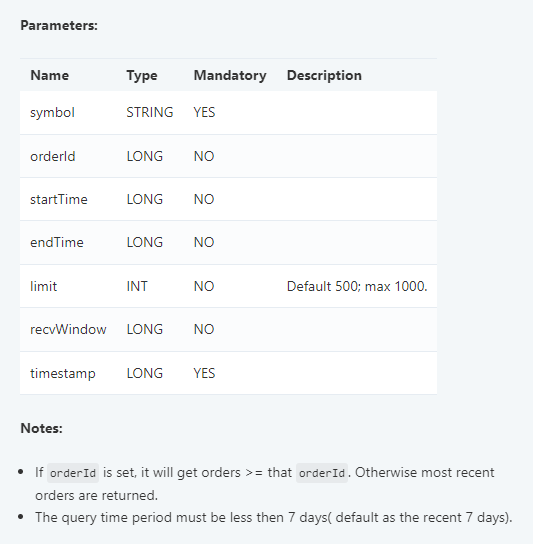

// If the symbol is not sent, orders for all symbols will be returned in an array.get all orders

var a = await binance.allOrders(apiKey, apiSecret, {

symbol: 'BTCUSDT',

});

console.log("aa", a)

//Get all account orders; active, canceled, or filled.

// Parameters:

//

// Name Type Mandatory Description

// symbol STRING YES

// orderId LONG NO

// startTime LONG NO

// endTime LONG NO

// limit INT NO Default 500; max 1000.

// recvWindow LONG NO The value cannot be greater than 60000

// timestamp LONG YESNotes:

If `orderId` is set, it will get "orders" >= that "orderId". Otherwise most recent orders are returned.

For some historical orders "cummulativeQuoteQty" will be < 0, meaning the data is not available at this time.

If "startTime" and/or "endTime" provided, "orderId" is not required.FUTURES:

order

let newOrder = await binance.futuresOrder({

symbol: 'BTCUSDT',

side: 'BUY',

type: 'MARKET',

quantity: 1,

positionSide: 'LONG',

})Name Type Mandatory Description

symbol STRING YES

side ENUM YES

positionSide ENUM NO Default BOTH for One-way Mode ; LONG or SHORT for Hedge Mode. It must be sent in Hedge Mode.

type ENUM YES

timeInForce ENUM NO

quantity DECIMAL NO Cannot be sent with closePosition=true(Close-All)

reduceOnly STRING NO "true" or "false". default "false". Cannot be sent in Hedge Mode; cannot be sent with closePosition=true

price DECIMAL NO

newClientOrderId STRING NO A unique id among open orders. Automatically generated if not sent. Can only be string following the rule: ^[\.A-Z\:/a-z0-9_-]{1,36}$

stopPrice DECIMAL NO Used with STOP/STOP_MARKET or TAKE_PROFIT/TAKE_PROFIT_MARKET orders.

closePosition STRING NO true, false;Close-All,used with STOP_MARKET or TAKE_PROFIT_MARKET.

activationPrice DECIMAL NO Used with TRAILING_STOP_MARKET orders, default as the latest price(supporting different workingType)

callbackRate DECIMAL NO Used with TRAILING_STOP_MARKET orders, min 0.1, max 5 where 1 for 1%

workingType ENUM NO stopPrice triggered by: "MARK_PRICE", "CONTRACT_PRICE". Default "CONTRACT_PRICE"

priceProtect STRING NO "TRUE" or "FALSE", default "FALSE". Used with STOP/STOP_MARKET or TAKE_PROFIT/TAKE_PROFIT_MARKET orders.

newOrderRespType ENUM NO "ACK", "RESULT", default "ACK"

recvWindow LONG NO

Order with type STOP, parameter timeInForce can be sent ( default GTC).

Order with type TAKE_PROFIT, parameter timeInForce can be sent ( default GTC).

Condition orders will be triggered when:

If parameterpriceProtectis sent as true:

when price reaches the stopPrice ,the difference rate between "MARK_PRICE" and "CONTRACT_PRICE" cannot be larger than the "triggerProtect" of the symbol

"triggerProtect" of a symbol can be got from GET /fapi/v1/exchangeInfo

STOP, STOP_MARKET:

BUY: latest price ("MARK_PRICE" or "CONTRACT_PRICE") >= stopPrice

SELL: latest price ("MARK_PRICE" or "CONTRACT_PRICE") <= stopPrice

TAKE_PROFIT, TAKE_PROFIT_MARKET:

BUY: latest price ("MARK_PRICE" or "CONTRACT_PRICE") <= stopPrice

SELL: latest price ("MARK_PRICE" or "CONTRACT_PRICE") >= stopPrice

TRAILING_STOP_MARKET:

BUY: the lowest price after order placed <= activationPrice, and the latest price >= the lowest price * (1 + callbackRate)

SELL: the highest price after order placed >= activationPrice, and the latest price <= the highest price * (1 - callbackRate)

For TRAILING_STOP_MARKET, if you got such error code.

{"code": -2021, "msg": "Order would immediately trigger."}

means that the parameters you send do not meet the following requirements:

BUY: activationPrice should be smaller than latest price.

SELL: activationPrice should be larger than latest price.

If newOrderRespType is sent as RESULT :

MARKET order: the final FILLED result of the order will be return directly.

LIMIT order with special timeInForce: the final status result of the order(FILLED or EXPIRED) will be returned directly.

STOP_MARKET, TAKE_PROFIT_MARKET with closePosition=true:

Follow the same rules for condition orders.

If triggered,close all current long position( if SELL) or current short position( if BUY).

Cannot be used with quantity paremeter

Cannot be used with reduceOnly parameter

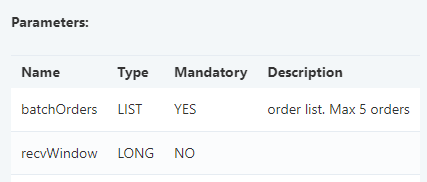

In Hedge Mode,cannot be used with BUY orders in LONG position side. and cannot be used with SELL orders in SHORT position sidebatchOrders

let batchOrders = await binance.batchOrders({

batchOrders: 'BTCUSDT',

})

Paremeter rules are same with New Order

Batch orders are processed concurrently, and the order of matching is not guaranteed.

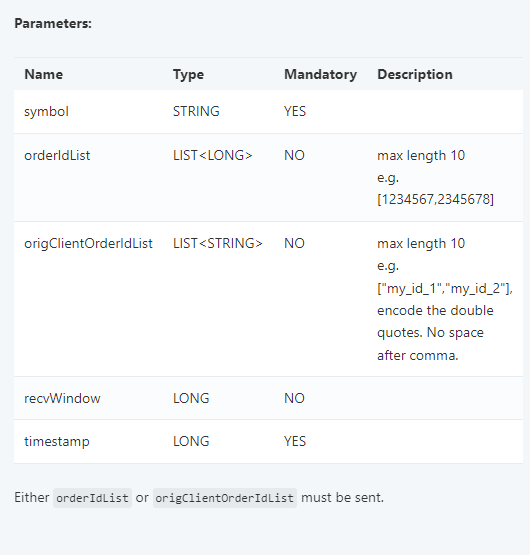

The order of returned contents for batch orders is the same as the order of the order list.getOrders

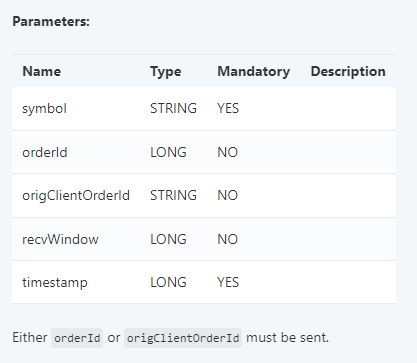

let batchOrders = await binance.getFuturesOrder({

symbol: 'BTCUSDT',

})

deleteFuturesOrder

let deleteOrders = await binance.deleteFuturesOrder({

symbol: 'BTCUSDT',

})

deleteAllFuturesOpenOrder

let deleteOrders = await binance.deleteAllFuturesOpenOrder({

symbol: 'BTCUSDT',

})

getAllFuturesOpenOrder

let deleteOrders = await binance.getAllFuturesOpenOrder()

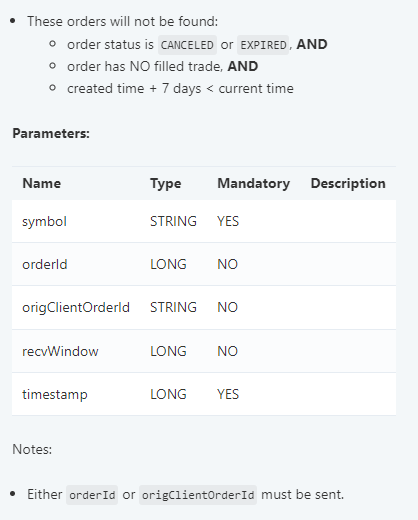

allFuturesOrders

let allFuturesOrders = await binance.allFuturesOrders({

symbol: 'btcusdt'

})Get all account orders; active, canceled, or filled.

These orders will not be found:

order status is CANCELED or EXPIRED, AND

order has NO filled trade, AND

created time + 7 days < current time

FuturesBalance

let FuturesBalance = await binance.FuturesBalance()leverage

let leverage = await binance.leverage({

symbol: 'btcusdt'

})

nobitex

orderbook

await orderbookNobitex('BTCUSDT')add order

let a = await binance.addOrderNobitex({

type: 'buy',

execution: 'market',

srcCurrency: 'usdt',

dstCurrency: 'eth',

amount: 0.0623,

price: 121000,

stopPrice: 118000

});

console.log('a', a)check status order

console.log(await binance.checkOrderNobitex({

id: 5634,

}))نکات تکمیلی مشاهده وضعیت سفارش

change status order

console.log(await binance.changeOrderNobitex({

order: 4561,

status: 'canceled'

}))توضیحات نحوه کنسل و فعال کردن یک سفارش + نوع پارامتر های ورودی

How to setup

npm install

# run test

npm run testLicense

صلوات بفرست